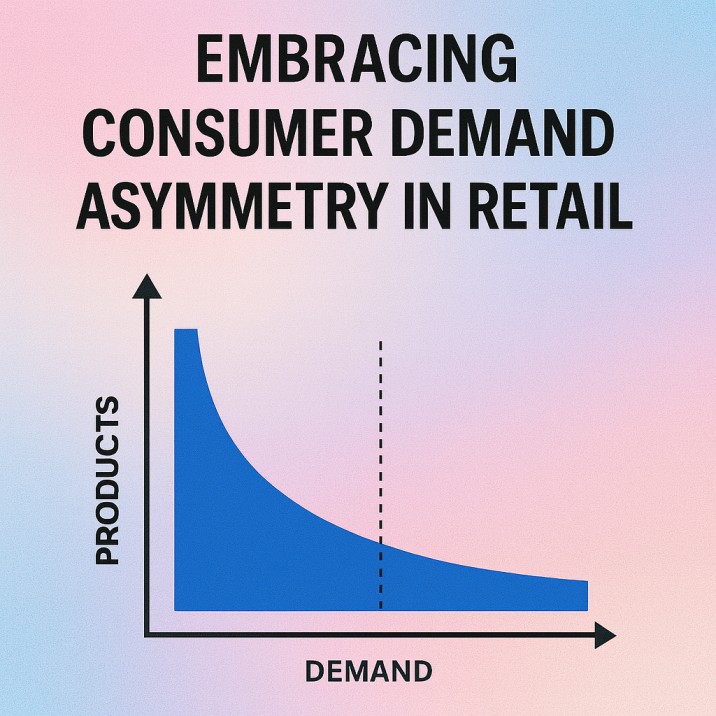

Embracing Consumer Demand Asymmetry in Retail

Life lessons from an “asymmetric” mindset and a practical operating system for retailers

A quick note on what sparked this article

A widely shared “last lecture” at Stanford by Graham Weaver popularized a simple and uncomfortable truth: not every decision carries equal weight. Certain actions create outsized results compounding over time while others barely move the needle. Call it living asymmetrically. The idea travels well beyond personal growth. Look closely at any retailer’s P&L and you’ll notice the same pattern in disguise: a minority of products and choices deliver a majority of the outcomes.

This article translates that life lesson into a pragmatic operating system for consumer demand asymmetry in retail. We’ll explore where asymmetry shows up across categories (fashion, home, home improvement, pet supplies, auto components), why symmetric betting creates waste, how AI agents change the cadence of decisions, and how to run your business so your bets respect the terrain rather than fight it. You’ll also find relevant Stylumia articles linked where they deepen the thinking, and a light, non‑salesy note at the end on where Stylumia typically fits.

1) Asymmetry, plainly stated

In life and retail, inputs and outputs aren’t linear. A few relationships, habits, or decisions have disproportionate impact. The same is true of products, prices, promotions, and suppliers. That’s the practical meaning of consumer demand asymmetry in retail: the distribution of what matters is lopsided.

What goes wrong inside organizations isn’t asymmetry itself , it’s pretending the world is symmetric. We spread attention evenly, buy evenly, promote evenly, and then wonder why we carry excess inventory while missing obvious winners. The message is not “be bold for the sake of it.” It’s “size bets according to reality.”

One line you can use internally: Asymmetry is good if our bets respect it.

2) Where the asymmetry shows up (and how it hides)

Heavy‑tailed product performance. In every category I’ve worked with, a small set of SKUs carries the margin while a long tail crawls. That’s not failure; it’s the shape of demand. Your job isn’t to flatten the curve , it’s to align investment with it.

Noisy proxies for demand. Certain “signals” masquerade as consumer pull: stock‑outs caused by tiny buys, sudden social spikes driven by placement rather than preference, or site search anomalies driven by merchandising changes. Treating every noise blip as demand drags teams back toward symmetric “cover‑all‑bases” behavior.

Institutional symmetry. Plan templates, “fair share” allocations, and calendar rituals nudge us to be equal. Equality feels safe. In an asymmetric world, it’s expensive.

3) A clear definition of consumer demand asymmetry in retail

Let’s define it so teams can operationalize it:

Consumer demand asymmetry in retail is the persistent pattern where a small share of products, attributes, and moments capture a disproportionate share of demand and profit and where that mix evolves as preferences shift.

Two practical implications fall out:

- Bet sizing beats raw picking. Choosing a trend or a SKU is only half the job; how deep and how fast you go matters more than the pick itself.

- Forward signals beat lagging history. History over‑funds yesterday’s winners and under‑funds emergent ones. Build a true‑demand layer that separates preference from availability and shelf artifacts.

- For a conceptual foundation, see Stylumia’s framing of Demand Science and the traps of using stock‑outs as proof of demand: — Demand Science for Fashion: Game Changer in Demand Forecasting , Stock‑Out Lies: Demand Intelligence Reimagined

4) From symmetry to alignment: a four‑step operating system

Step 1 See real demand early

Blend independent leading indicators:

- Language signals: what people type, ask, and talk about.

- Visual signals: the aesthetics they save, like, and linger on.

- Attribute arcs: materials, ingredients, sizes, benefits, silhouettes.

- Contextual cues: seasonality, events, weather, regional nuance.

Filter shelf artifacts (availability, quirky placements) so you don’t confuse logistics with love.

Step 2 Size the bet, not just the pick

Translate signal strength into buy depth, initial distribution, and expansion thresholds. Weight by volatility, unit economics, and substitution risk. In my experience, a simple rule helps: the stronger and more independent the signals, the larger and faster the bet; the weaker or correlated the signals, the smaller and more test‑and‑learn the bet.

Step 3 Instrument the loop with AI agents

Instead of asking analysts for one‑off decks, assign work to specialized agents with guardrails Assortment Agent, Buy‑Depth Agent, Pricing Agent, Replenishment Agent, Markdown Agent, even a Supplier‑Negotiation Agent. They don’t replace judgment; they make the obvious moves fast and transparent so humans can apply judgment where it counts.

Step 4 Close the loop

Score every decision on return on inventory and return on attention. Feed the outcomes back to your agents. Keep a human‑in‑the‑loop for exceptions and policy. Over a few cycles, you’ll see less debate about personal taste and more conversation about signal‑to‑bet alignment.

5) A quick diagnostic: are your bets symmetric in an asymmetric world?

- Do your top‑decile SKUs actually receive top‑decile inventory and creative attention—or does everything get the same calendar slice?

- Does open‑to‑buy flex up or down when leading indicators break trend?

- Do you ever pause a style, ingredient, or part before sales decline because signals softened?

If those answers skew “no,” you’re treating an asymmetric terrain like a flat field.

6) Category field notes: how consumer demand asymmetry in retail behaves

A) Fashion & apparel

Fashion is lumpy by nature. Micro‑trends flare; a small set of hero products funds the month; the rest mostly fills space. Buying evenly is the refuge of the nervous. Precision is the work of the confident.

- Asymmetry pattern: A minority of silhouettes, palettes, and fabrications carry the gross margin.

- Common miss: Confusing stock‑outs or limited drops with broad‑based consumer pull.

- Alignment move: Score candidate trends and archetypes with independent signals, then scale bet size dynamically.

- For practical lenses and strategic framing: Are You Competing, or Are You Different? Escaping the Equilibrium: Nash Equilibrium in Retail Strategy The Power of Constraints in Trend Spotting

B) Home & décor

Home feels stable until an aesthetic mood swings—quiet luxury, warm minimalism, earthy textures—and consumer preferences tilt overnight.

- Asymmetry pattern: A few anchor collections or SKUs carry the line; many accessories are passengers.

- Alignment move: Use image‑based preference signals to detect aesthetic turns early and pair buy depth with creative depth. Treat accessories as attach plays, not headline bets.

C) Home improvement (DIY/Pro)

Project‑centric demand makes the category feel unpredictable, but the asymmetry is predictable: project‑critical SKUs matter; completeness SKUs follow.

- Asymmetry pattern: Roofing, windows, HVAC, adhesives, and fasteners dominate throughput at specific moments.

- Alignment move: Wire a Replenishment Agent to prioritize project‑critical SKUs when leading indicators pop (permits, weather, local search language), and hold long‑tail inventory to tighter minimums.

D) Pet supplies

Pet is quietly asymmetric. Premium food and wellness are magnets for trust; the long tail of toys and accessories is… long.

- Asymmetry pattern: Functional “jobs” (digestive health, skin/coat, calming) and trusted nutrition formats drive repeat demand.

- Alignment move: Architect assortments around those jobs. Use a Bundle Agent to pair slow‑moving adjuncts with hero formats customers already trust, raising attach without clutter.

E) Auto components (aftermarket)

The aftermarket is a long‑tail universe: many SKUs, intermittent demand, and strong regional/vehicle variance.

- Asymmetry pattern: Fitment and regional fleet composition create natural skew.

- Alignment move: Use VIN‑aware demand signals and a Parts Substitution Agent that understands safe equivalence by fitment. Size bets to real local need, not corporate averages.

Across categories the refrain is the same: find the few; size the bet; let agents keep pace.

7) AI agents: from slides to shop‑floor decisions

A decade ago we asked analysts for insights; now we ask agents to do work within guardrails. In my experience, the shift is less about intelligence and more about workflow moving from static analysis to continuous, explainable action.

A practical agentic stack for consumer demand asymmetry in retail:

- Signal Agent : merges language, visual, and attribute signals; filters noise; outputs ranked demand candidates with confidence.

- Assortment Agent : proposes sets and buy depth; simulates space and cannibalization before you commit.

- Pricing & Promo Agent : nudges prices against elasticity; protects heroes from blunt promo.

- Replenishment Agent : keeps high‑throughput SKUs healthy and throttles long‑tail orders.

- Markdown Agent : acts earlier on weak‑signal SKUs to save margin dollars rather than units.

- Supplier‑Negotiation Agent : packages intents into supplier‑ready bundles aligned to asymmetric needs.

- Audit Agent : reviews agent decisions for policy alignment, bias, and safety, and explains why actions were taken.

Two non‑negotiables:

- Guardrails & observability: Agents must show their work (signals used, options considered) and allow a human override.

- Outcome‑aligned incentives: Tie evaluation to business outcomes sell‑through, cash conversion, working capital turns not vanity metrics.

8) Making the bets: a simple, asymmetry‑aware metric set

Resist the urge to multiply KPIs. Track a tight set that forces alignment:

- Asymmetry Alignment Index (AAI) : correlation between investment weight (buy depth + creative time) and a forward demand score. Aim to move it toward 1.

- Hero Concentration Ratio : % of margin dollars from your top decile of SKUs. Watch the trend: are you manufacturing heroes or just getting lucky?

- Expansion Hit Rate : % of SKUs that met goals after you scaled up based on signals.

- Early Markdown Save : % of markdown dollars taken before velocity collapse (your agility dividend).

- Return on Attention (RoA) : margin dollars per hour of merchant/analyst time by class or program.

- Buy‑to‑Signal Delta : the gap between planned buys and demand scores at commit time; shrinking deltas signal sharper bets.

- Long‑Tail Hygiene : % of SKUs below a velocity threshold with an explicit exit or bundling plan.

These aren’t for dashboards; they’re for monthly bet reviews where teams recalibrate, reallocate, and retire.

9) How this reframes everyday decisions

- Assortment planning shifts from “Which 240 SKUs?” to “Which 70 really matter, and how deep for each?” The difference shows up in returns, not in slides.

- Open‑to‑buy becomes a flex pool that agents can tap when signals break trend, instead of a rigid envelope.

- Supplier negotiations reward optionality (lower MOQs, faster re‑buys) where asymmetry is highest; you stop over‑optimizing price on low‑impact SKUs.

- Visual merchandising & PDPs give heroes obsessive clarity and social proof; the long tail gets crisp basics, not fanfare.

- Markdowns move earlier and smarter. It’s cheaper to save dollars than to save units.

10) A worked example: turning signals into scaled bets

Context: You’re a multi‑category retailer. A language monitor shows rising queries for “air‑purifying plants” and “low‑maintenance indoor planters.” Image signals show matte ceramic textures trending. Social clusters surface “self‑watering” as the enabling attribute.

What changes:

- Signal Agent scores the combination highly and tags it “rising.”

- Assortment Agent proposes:

- Deepen buy on three self‑watering planters in 8–10″ sizes with matte textures (hero bets).

- Maintain a minimal tail of experimental shapes (trail bets) for learning.

- Pricing & Promo Agent protects the hero bets from blanket promotions; nudges price on long‑tail variants.

- Markdown Agent sets an exit date for experimental shapes if momentum dips below threshold.

- Creative & ops pair buy depth with story depth: content centers on the job to be done (cleaner air, lower maintenance) and links the right bundles (soil, tools).

Five‑week review:

- AAI rises as investment weight aligns with signal weight.

- Expansion hit rate lands 2/3 on the scaled heroes; the miss exited early with a respectable Early Markdown Save.

- RoA jumps because teams spent time where outcomes live.

That pattern not a single tool is the win.

If you’re leading merchandising, planning, pricing, or a cross‑functional retail team, your job is to create an environment where reality sets the bet:

- Reward finding and funding the few, not just filling the many.

- Ask to see AAI and Buy‑to‑Signal Delta at monthly reviews; make reallocations a habit, not an exception.

- Expect agents to explain actions and outcomes; expect humans to intervene less often because the system is well‑tuned, not because they checked out.

- Protect working capital by treating speed as a form of accuracy: earlier, smaller corrections beat late, heroic ones.

No, this doesn’t make life or retail predictable. It makes your choices more predictably good.

12) Where Stylumia tends to help (education‑first)

If you want to go deeper on the demand and agent pieces, these Stylumia reads are a useful primer (links verified at publication):

- Demand Science: Demand Science for Fashion | Game Changer in Demand Forecasting — the True‑Demand idea generalizes across retail.

- Noisy proxies: Stock‑Out Lies: Demand Intelligence Reimagined — why stock‑outs mislead and what to use instead.

- Agent lens: Introducing Stylumia Orbix: The GenAI Trend Agent — how agentic workflows identify and action preference shifts.

- Strategy: Escaping the Equilibrium: Nash Equilibrium in Retail Strategy — don’t mirror competitors; anchor in demand.

- Precision & constraints: The Power of Constraints in Trend Spotting — narrowing the aperture to raise signal quality.

- Agentic commerce: The Agent Revolution: Product Information Is the New Commerce Battleground — get catalogs and content agent‑ready.

- From blindfold to bullseye: Unleashing New‑Age Retail Intelligence — building a precision engine.

In closing,

The lecture that started this journey was about living with intent placing more chips on the few actions that change your trajectory, and fewer on the rest. Retail is the same story, told through buys, promos, and product pages. Let the few that matter pull your attention and capital. Teach your agents to do the same. When your system respects consumer demand asymmetry in retail, you stop fighting the terrain and start moving with it.

That’s when the numbers begin telling a calmer, better story.

Frequently Asked Questions

Q1. What is consumer demand asymmetry in retail?

Consumer demand asymmetry in retail is the reality that a small share of products, attributes, or moments drive a disproportionate share of demand and profit, while most others contribute only marginally.

Q2. Why do symmetric bets fail in retail?

Symmetric bets assume every product has equal potential. Since demand is asymmetric, equal allocation leads to over-funding weaker products and under-funding winners causing waste, markdowns, and lost profit.

Q3. How can retailers align with consumer demand asymmetry?

By using demand science and AI-driven intelligence, retailers can detect leading consumer signals, size bets proportionately, and continuously adjust assortments, pricing, and replenishment in real time.

Q4. What role do AI agents play in retail decision-making?

AI agents help retailers act on signals automatically proposing assortments, scaling buys, adjusting prices, and triggering early markdowns while humans provide oversight and judgment where it matters most.

Q5. Is consumer demand asymmetry only relevant to fashion?

Not at all. It applies across all categories including home décor, home improvement, pet supplies, and auto components. The asymmetric shape of demand is universal; only the drivers of consumer preference vary.