[Trend] Consumer Response To Inflationary Pricing

The recent global economic outlook by KPMG (read the detailed report by country here) forecasts,

a) Russia-Ukraine war to lower global growth prospects and increase inflationary pressures

b) Central banks’ change in policy stance could add to market volatility

c) Ongoing geopolitical uncertainties could see further disruptions to production and trade

Under these conditions, we analyse how brands and retailers are doing pricing changes and what is the consumer response to the inflationary pricing in select segments. While it is easier to spot what the brands are doing, it is non-trivial to spot the consumer demand for the changes in prices. The insights in this edit are derived from the proprietary demand-sensing through Stylumia Consumer Intelligence Tool.

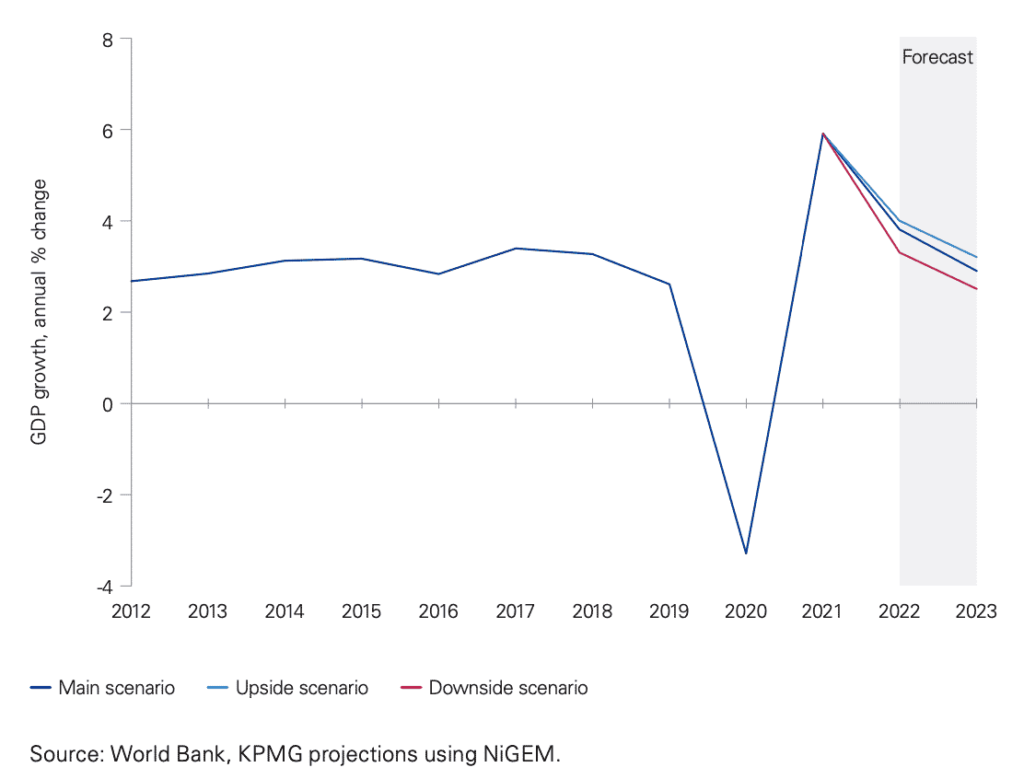

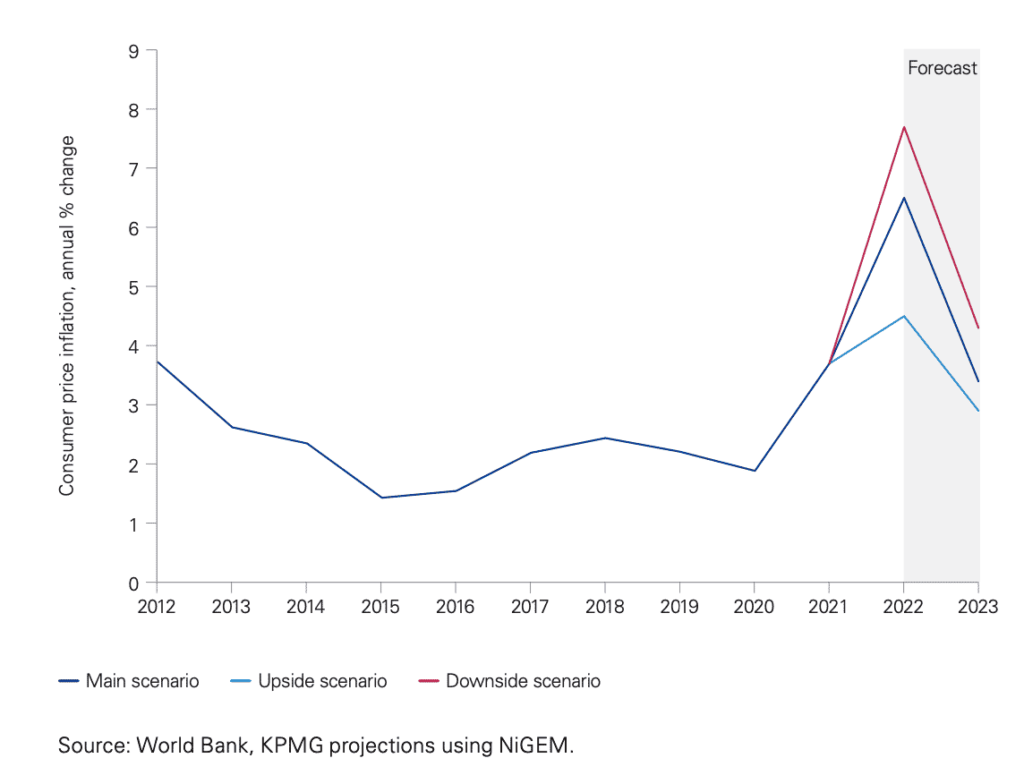

Macro-Economic OutLook

The KPMG outlook presents three scenarios on global GDP growth rates. The growth rates drop from 2021 levels in 2022 and 2023, coming back to pre covid growth rates.

The inflation trend is ending up well above pre covid times even in 2023 across all the three scenarios.

Are Brands & Retailers Inflating Prices?

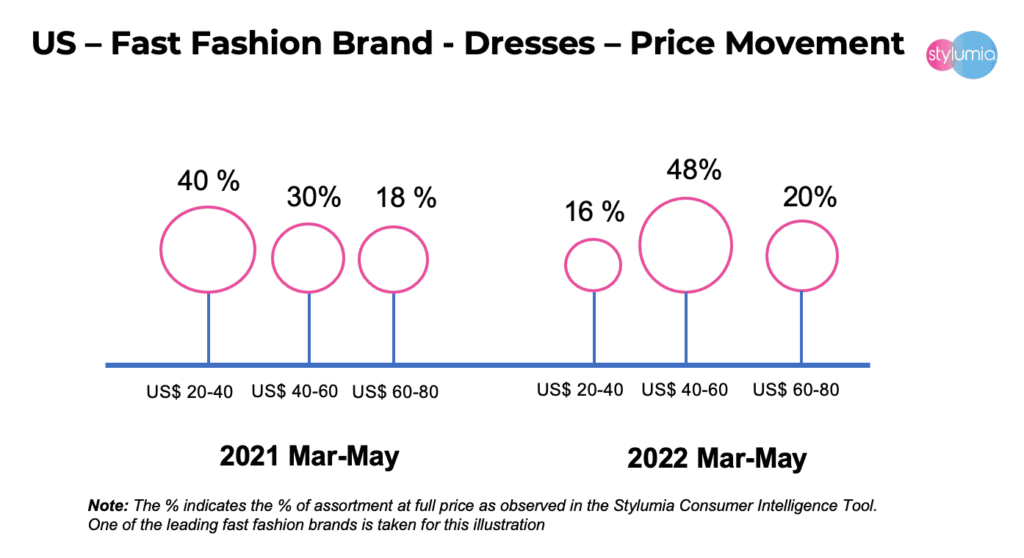

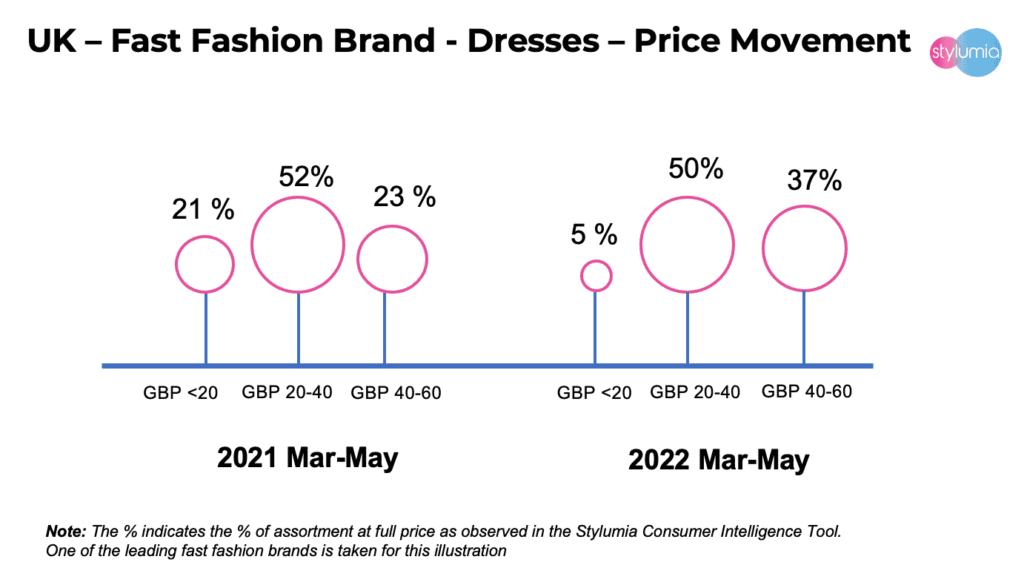

We compared the retail list price (full price) of select brands and retailers in the standard and fast-fashion segments. The time period of comparison is March to May 2022 over the same period in 2021. We considered all products trading during this period for the analysis.

The data indicates brands have increased their pricing. We deep-dived into a leading fast fashion brand, across US and UK markets.

In the United States, the supply has significantly declined in price points US$ 20-40 ( by 57.5%) and increased in the bands US$ 40-60 (by 60%) and US$ 60-80 (by 11%).

In the UK Market, the supply has significantly declined in price points GBP 0-20 ( by 76%) and GBP 20-40 (by 4%) and increased in the price band GBP 40-60 (by 65%).

While the brand is increasing prices, what is the consumer response? Are consumers accepting the inflationary pricing or resisting paying more? This calls for understanding consumer demand.

What Is The Consumer Response To Inflationary Pricing?

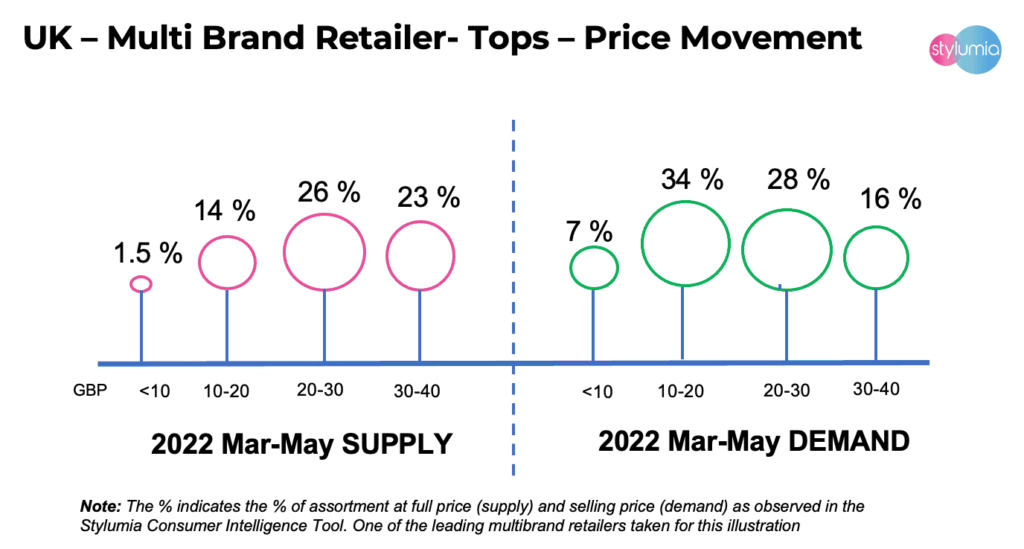

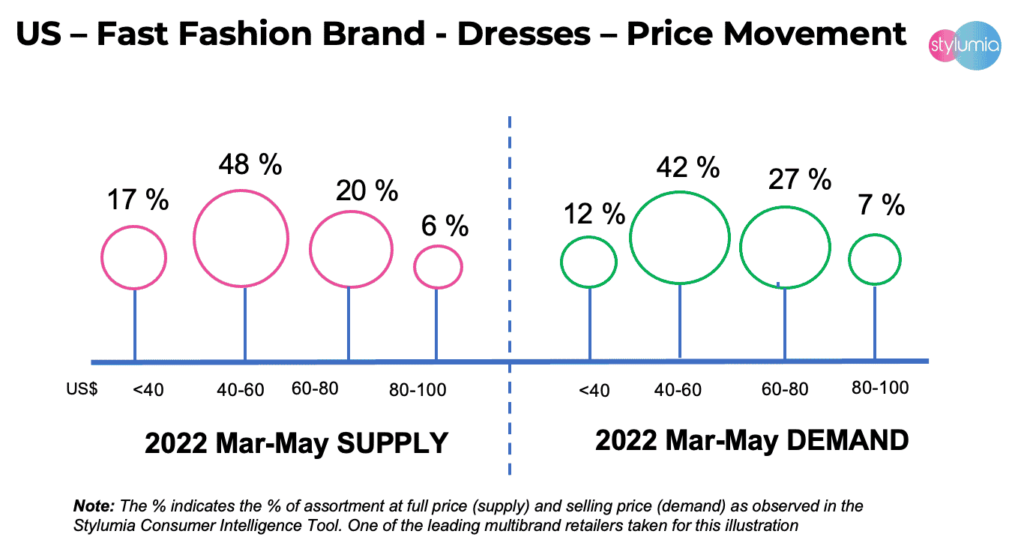

We looked at the women’s tops category in the UK market and women’s dresses in the US market to understand the demand patterns of top-performing products and their selling price distribution in comparison with supply. When we compare the supply and demand price patterns, we can see if the category demonstrates the elasticity of demand for the price changes.

The demand-supply ratio in price bands GBP <10 (466%) and GBP 10-20 (243%) clearly indicate the consumer demand for tops is not showing elasticity in these popular ranges. We see elasticity is different across categories, for eg., dresses do not show as much resistance as tops.

We see a differing consumer demand pattern in women’s dresses in the US market. There is a contraction in the demand ratio in the first two price buckets US$ <40 (-29%) and US$ 40-60 (-12.5%).

This is an indication of different consumer behaviour across categories and geographies.

It is imperative for brands to understand the holistic consumer demand in different markets and categories apart from understanding their own data. Right-pricing and localisation can generate relevant market-share capture, revenue and hence profitability.

With the skew in the demand and supply, we anticipate inventory pile-up in the inelastic price ranges and resultant markdowns for clearance.

In Conclusion,

The analysis clearly shows consumers are not taking the price increases in the same proportion as the brands are planning. What this means is there will be a migration of demand across the players.

Those brands who make informed decisions and take course corrections will come out of this period with less damage in gross margin and market share than the others.

Right Pricing and corrections will play a key role in managing both top and the bottom line.

If you would like to stay on top of consumer demand trends and pricing for informed decisions for your categories and markets, please reach out for a free discovery session here.