Strategic Direction For Post COVID-19 Fashion Market

While the pandemic is impacting lives and the economy now, this is the time to reflect and get prepared for the coming quarters ahead i.e the post-COVID-19 fashion market. This edit looks at the consumer psychology post-COVID-19 pandemic fashion, a strategic view on the market ahead, and what are the five ways to get prepared. This is backed by research from Harvard Business School after studying downturns over the last few decades.

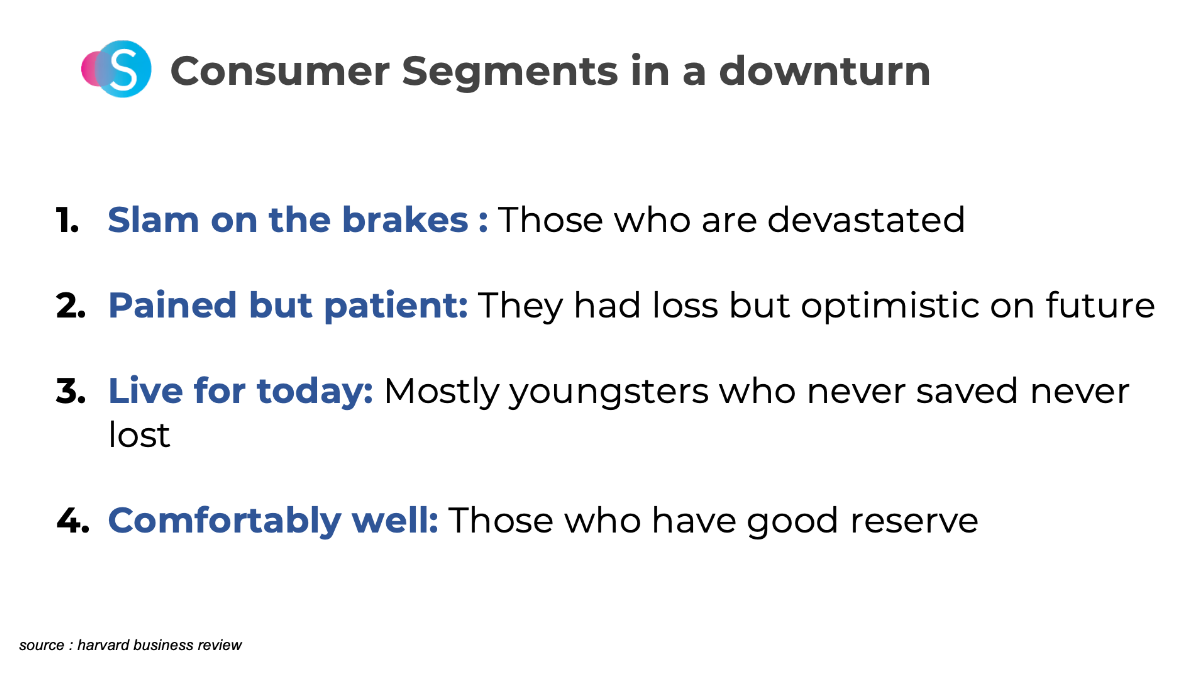

Let us start with consumer psychology in a downturn.

# Consumer segments during a downturn

Traditional segmentation of consumers does not work during a downturn. Neither the lifestyle nor the demographic will help you place your consumers in a cluster. John Quelch puts the consumer in four segments during a downturn. You need to be clear on which of these segments that you will be targeting.

How can you address these consumers and manage through the downturn and also come out stronger?

Here are the five ways you could do that.

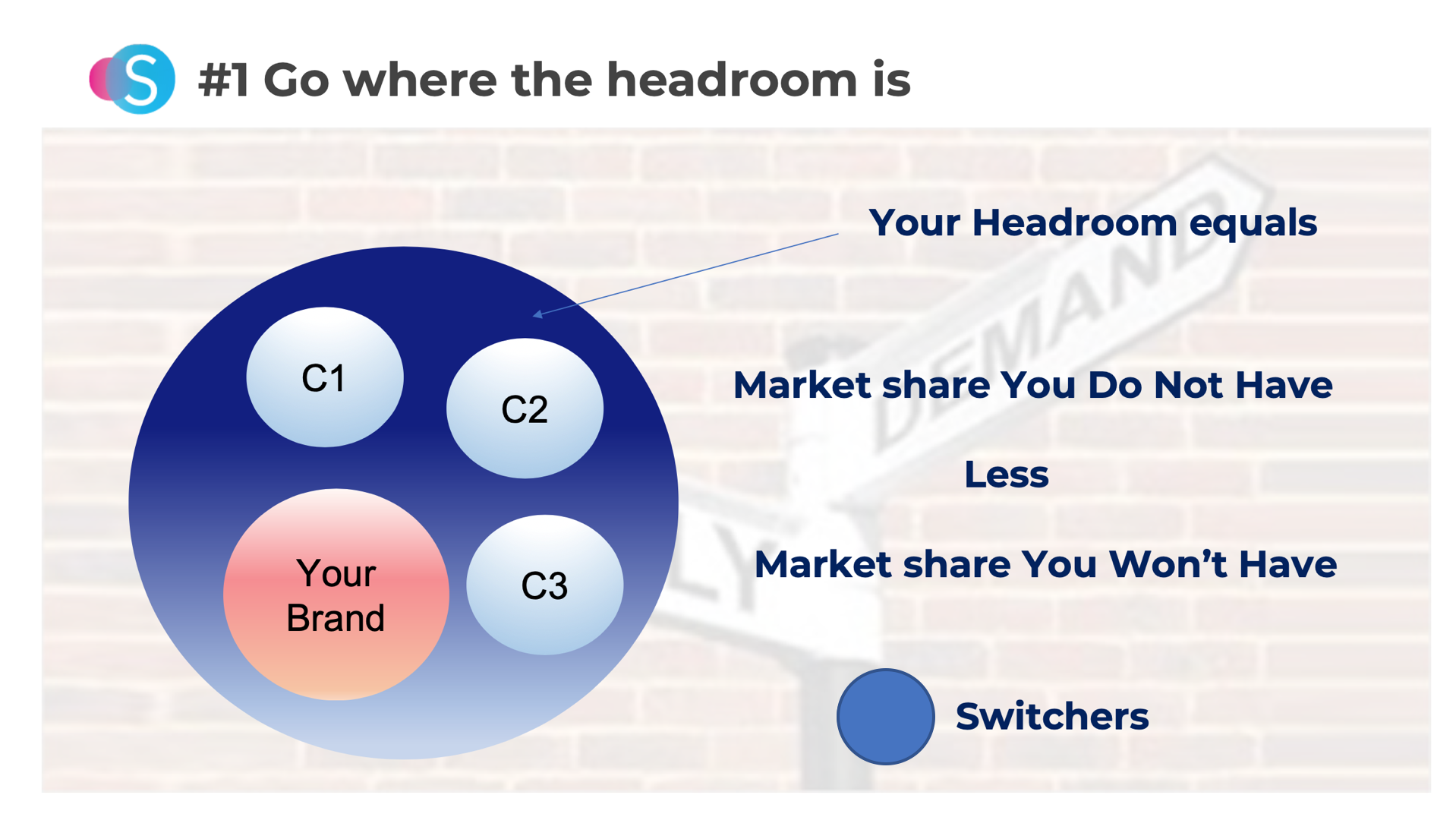

#1 Go where the headroom is

There is a high probability that you will keep the share of your loyal customers, provided you meet their needs during the period and considering the new segment they will fall into. It is a low probability that you will get the share of loyal customers of your competition (c1/c2/c3). In order to take a larger share of the market, you need to target the “switchers”, who are neither loyal to you nor loyal to your competitors. They are not the segment you focussed on thus far, hence that needs intelligence to understand them before you serve them.

#2 Close the need-offer gap

You need to understand the new needs of your loyal customers and also the switchers. This also needs intelligence from outside-in the organization to identify and adjust the product/value offerings. The traditional way of looking into just the past data will not help.

#3 Go after bad costs

Instead of cutting costs in general, it is prudent to go after bad costs. Bad costs are those which do not give customer benefit. Instead of going with your intuition of what will drive customer benefit, evaluate impact in the medium term and then take your decision. Blind cutting of cost can impact you adversely.

#4 Time to hyper-localize during the pandemic

It is the stores (digital or physical) that generate revenue. You need to super-curate merchandise in the new context for each store and that too dynamically. Take care of the store, you will take care of your business.

#5 Re-invent / Re-tool your core processes for post COVID-19 fashion market

The four ways mentioned above needs constant intelligence flowing into the organization and also the capability to take decisions with all the information. This would call for re-tooling all core processes of design, consumer/market research, merchandise planning, and distribution.

In conclusion,

What got us here may not get us forward.

These are times to not only step back but also look at the scenarios ahead and re-plan. It is not a bad idea to over-index the problem so that we get fully prepared for such an eventual future. It is also prudent to learn from what worked in the past downturns. Hope the 5 ways give you a framework to create plans for the post-COVID-19 market.

We at Stylumia did a global webinar last week organized by Anina.net, on the 5 ways to approach the post-covid-19 market and also how you can apply them using Stylumia solutions to get future-ready. Please click here or the image below to view the webinar recording (40 min)

If you are interested in applying the right strategy for post covid19 market scenario and apply them for your business to sustain and grow, transforming your product decisions by embedding intelligence, please reach out to us to make your business future-proof, before it’s too late.