2019: A Year Of Awakening For Fashion Players

The recent report on State of Fashion 2019 by Mckinsey/BOF captures popular sentiments across the global fashion industry. While the signals are popular sentiments, the exact impact on your business can be very different depending on how you adapt to the new paradigm. This edit looks at the top 5 trends for 2019 for fashion players from our point of view.

“You must be willing to let go of who you have been to become who you were meant to be.”

# Executive Summary

2019 presents a new paradigm wherein the fashion players need to be

1. Nimble

2. Digital-first

3. Faster speed-to-market

It will be prudent for the fashion players to self-disrupt themselves before others from the market do. This means experimentation becomes a key role in the playbook.

Mckinsey predicts a lower growth rate for 2019 over 2018 (3.5-4% from 4-5% n 2018). This will differ by geography and segment. This calls for building resilience and productivity improvements.

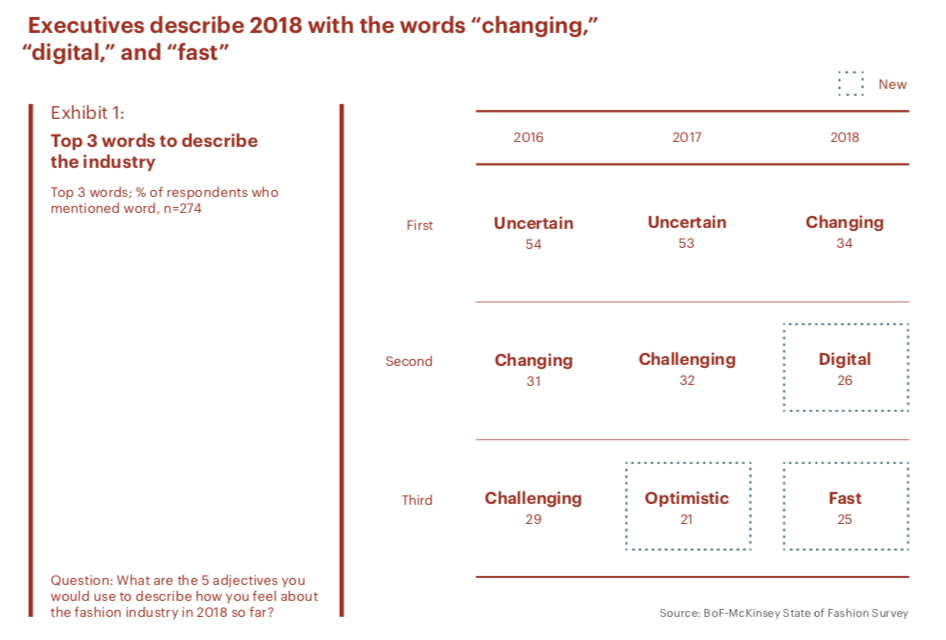

Top keywords used by leaders to describe 2018 “changing”,” digital” and “fast”

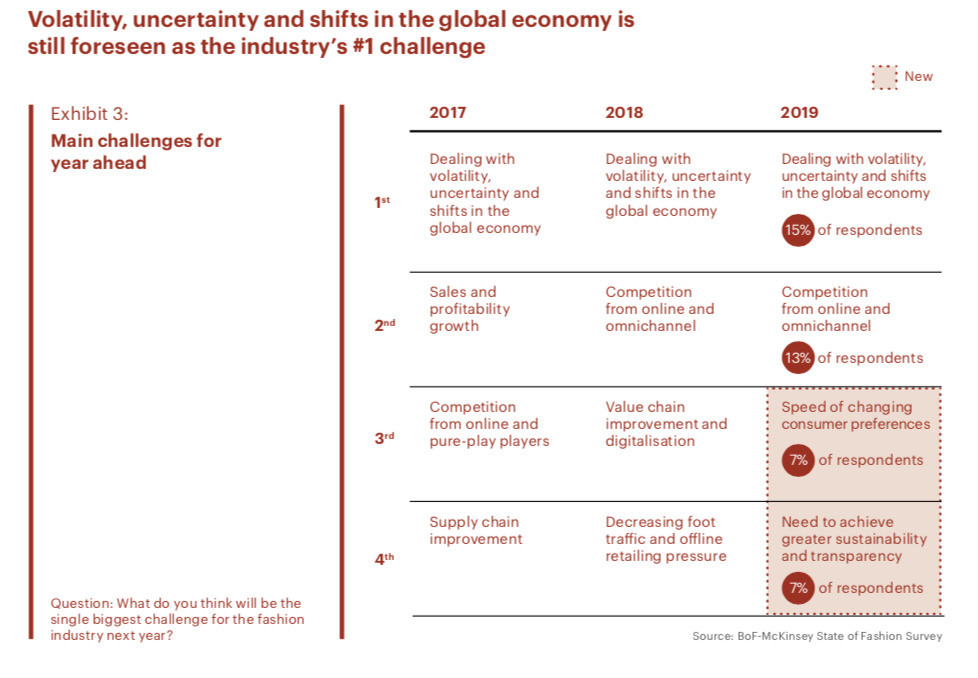

Key challenges for 2019 as per the leadership survey “Volatility” “Uncertainty” “Speed of changing consumer preferences” “sustainability”

AI gets real in 2018 and expects to take mainstream in 2019 and beyond. The AI work initiated by the founding team of Stylumia in Myntra, India’s largest online fashion retailer gets a mention in the report

# Trend 1: Consumer Shift – End of Ownership

A survey done in Britain found that one in three young women consider clothes old after they wear them once or twice. This is a clear reflection of people craving for “Newness”.

Also, research shows an average person buys 60% more clothing items than 15 years back and keep that clothing for only half as long as they used to.

While there will be a higher trend towards renting or pre-owned high-value items, we would like to interpret this to be a need for solving the “newness” challenge in the near term.

With half of the products made in the industry not selling at full price, the ways for the players to get their newness quotient right can be through:

1. Speedy mind to market

2. Make the right product in the first place

3. Look at innovating with the business model of ownership

# Trend 2: Consumer Shift – Instant Gratification

With the consumers getting ever-improving the speed of fulfilment from the likes of Uber, Amazon etc., the time lag expectation between discovery and purchase is coming down significantly. One key shift is in how consumers are getting inspired. They used to get inspired by in-store assistants of brands and retailers. Now that has shifted to multiple sources like social media, influencers and celebrities. A 2017 study shows about half of the respondents get influenced by bloggers, influencers compared with just 20% placing faith in the in-store assistants.

We see the need for the players to use technology solutions to minimise/crush the time between “want moment” to “have a moment“.

Also, there is an opportunity for offline retailers to promote products in-store with social / influencer credibility with real-time intelligence.

# Trend 3: Aggressive Productivity Improvements

With a potential slowdown in the global economy by 2020, players will look for key opportunities to boost productivity compared to previous years. Indian economy is showing the highest growth across all developing economies with over 8.0% GDP growth projection.

“More with Less” will be a theme the players would drive.

Our view on effectiveness in fashion is for the players to work on key areas to get maximum return on invested capital through:

1. Get Product Designs Consumer-Right: Use technology/big-data to drive decisions along with human intuition

2. Get quantity forecasts right: Use cutting-edge prediction models than just trade partner feedbacks in deciding volume bets.

3. Get distribution right: Shift from traditional replenishment and rule-based replacement models to sophisticated stock deployment using cognitive technology-enabled replacement/replenishment models. Also, present relevant propositions personalised to consumers across channels.

# Trend 4: Disrupt Yourself

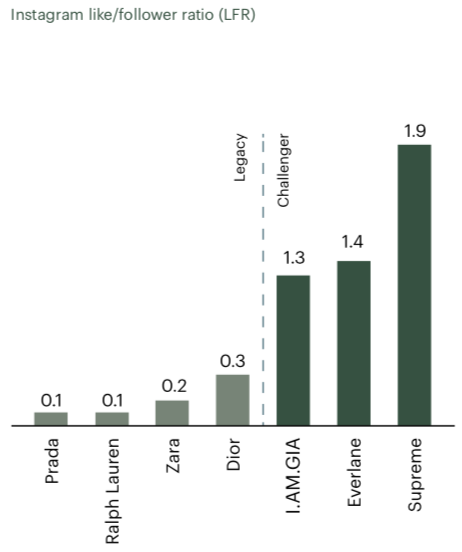

The best way to stay relevant is to disrupt yourself before someone else does. This is more critical in the context of technology and social media enabling a new breed of “challenger” brands to disrupt the incumbent players.

As per Mckinsey millennial survey, young generations are more likely to follow up-and-coming brands. These brands show high saliency and engagement in social media.

The incumbents need to build a way to stay relevant by

1. Learning how to think small

2. Work with start-ups

3. Build innovation bandwidth internally or through an incubator

# Trend 5: Push to Pull

This is a logical extension of the need for newness by consumers and high inefficiencies in the best-guess based push supply chain. Innovations in data analytics and automation will enable players to explore the “on-demand” model of fulfilling demand. There are a good number of startups in this area already and will enter the mainstream.

With social media, consumers are establishing trends as opposed to brands and retailers.

The players can look at the following interventions

1. Induct data-based demand sensing tools in the development process

2. Nearshore products

3. Experiment with on-demand supply in a select category and start building a culture

Hope this edit gave you a perspective on the state of fashion in 2019 and some potential interventions to be future-ready.